These funds are categorized based on the nature and duration of the restrictions imposed by the donors. By following these practices, nonprofits can maintain a clear financial record-keeping system that complies with regulatory requirements and supports organizational integrity. Here’s an example of Wellington Zoo’s annual report (page 45) that includes its statement of financial position or balance sheet.

A Detailed Guide on Nonprofit Balance Sheets (Examples & Sample)

In some cases, a nonprofit may approach the donor to discuss altering the terms, especially if the original purpose is no longer feasible or relevant. Restricted funds are donations given to a nonprofit with specific conditions attached by the donor regarding how the funds should be used. These could be for a particular project, program, or purpose and must be used accordingly. Schedule a live FastFund Demo now and discover the path to streamlined, stress-free accounting. Take the first step towards empowering your organization with the right tools for success. Most importantly, clear communication and documentation helps prevent misunderstandings, guaranteeing unintended use.

What Is Restricted Cash on a Balance Sheet? With Examples

The accounting requirements for restricted funds can be managed in a few different ways, depending on the accounting software being used and the sophistication of the chart of accounts. The most effective practice is to display grants and contributions with donor restrictions in a separate column. Using this two-column approach works for both the income statement and the balance sheet. As shown in the income statement below, new income from a grant with donor restrictions is recorded and displayed in the With Donor Restrictions column. FastFund Nonprofit Accounting provides specialized tools for tracking and reporting on restricted funds, ensuring compliance with donor restrictions and simplifying financial management for nonprofits.

Reporting Requirements

If a donor restricts a nonprofit organization to allocate funds to a specific purpose, it is required to do so by law. Failure to comply may result in the donor taking legal action and reporting the nonprofit to the Office of the U.S. If a situation arises that is serious enough to necessitate re-purposing restricted funds, it is necessary to obtain permission from the original donor(s) to remove the restriction. That is the only legal way to use the money for purposes other than the original restriction. Many state and local governments are experiencing revenue shortfalls and are facing difficult decisions in balancing their budgets.

- Permanently restricted are typically large donations that function as investment accounts or an endowment fund.

- The reason for the cash being restricted is usually disclosed in the accompanying notes to the financial statements.

- Donor-restricted funds introduce a level of complexity in nonprofit accounting.

- Fund accounting is a unique system designed for nonprofit organizations to ensure that they honor donor restrictions and manage their resources responsibly.

What are restricted funds in a nonprofit organization?

This distinction plays a critical role in the organization’s accounting practices. For example, it may or may not be held in a separate bank account designated for the purpose for which the cash is restricted. Regardless of whether the cash is held in a special bank account or not, restricted cash is still included in a company’s financial statements as a cash asset. Regular financial reviews help organizations stay on track and make necessary adjustments.

Fundraising Ideas for Nonprofits: Elevating Impact and Innovation

The sample income statement for 2018 shows $20,000 being released from restriction, while the remaining $40,000 remains in the With Donor Restrictions column. The same release of $20,000 will occur in future years two and three of the grant award. These funds are free from any external restrictions and available for general use.

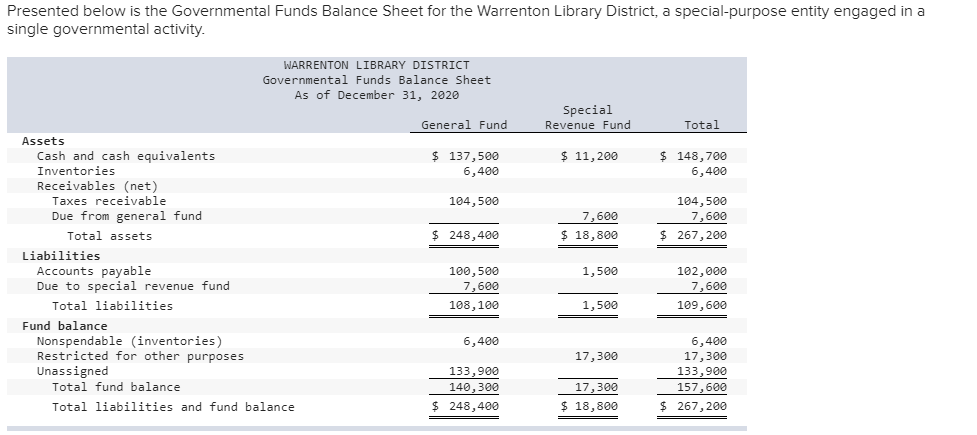

Despite their best efforts, Nonprofit X struggles with tracking these funds accurately using their current, generic accounting software. Challenges include ensuring compliance with donor restrictions, reporting accurately to stakeholders, and aligning funds with organizational expenses and projects. restricted funds on balance sheet When non-profits receive contributions, they must immediately determine whether these are temporarily restricted, permanently restricted, or unrestricted. To do this effectively, organizations should configure their accounting software to create separate ledger accounts for each category.

A permanently restricted fund, on the other hand, is expected to be put to the use specified by the donor in perpetuity. A common example of a permanently restricted fund is an endowment that requires the principal to be perpetually maintained in an investment fund, while the interest is applied to the donor’s instructions. How exactly are restricted funds meant to be handled and what are the methods open for nonprofits to manage these funds? When transferring funds from restricted to unrestricted status, the journal entry should debit the restricted net assets and credit the unrestricted net assets.

Additionally, depending on how long the cash is restricted for, the line item may appear under current assets or non-current assets. Cash that is restricted for one year or less is categorized under current assets, while cash restricted for more than a year is categorized as a non-current asset. Restrictions make nonprofit accounting unique from for-profit financial management. You should always understand which of your assets are restricted, what they’re restricted for, and how you can build your budget around them. Your nonprofit becomes more likely to run into restrictions as you grow and evolve. Understanding and having an effective system to handle restricted funds is key to minimizing their challenges in the future.